Mobile wallet app development has become a cornerstone of modern businesses, enhancing customer engagement in numerous ways. With the increasing use of smartphones and digital payments, integrating mobile wallets into retail and service apps has proven to be a game-changer. Businesses that embrace mobile wallet app development can foster better relationships with their customers by offering convenience, security, and efficiency in payments.

In this blog, we will explore the various ways mobile wallet app development boosts customer engagement, the benefits it brings to businesses, and why it’s critical for long-term success in today’s digital age.

What is Mobile Wallet App Development?

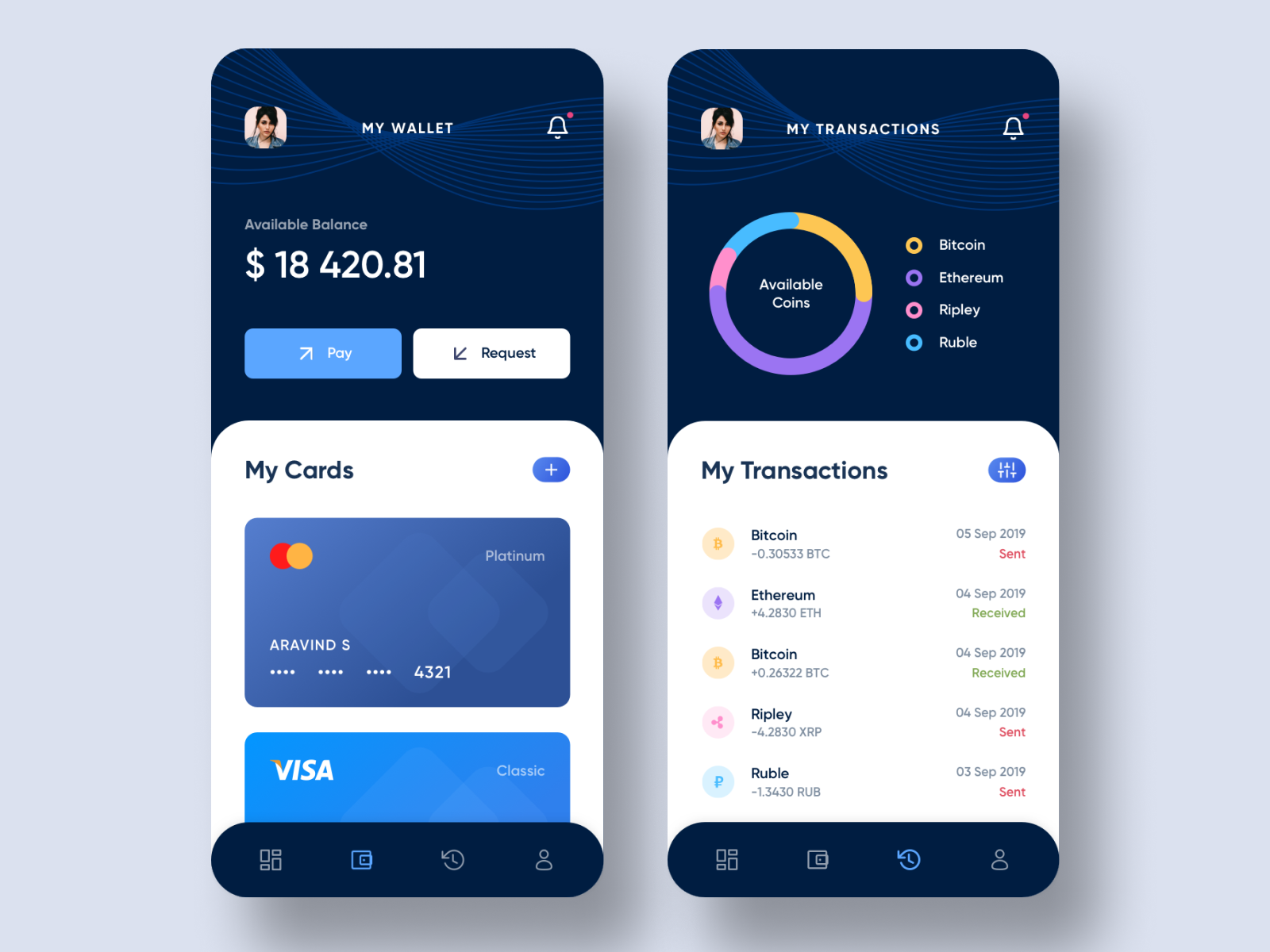

Mobile wallet app development is the process of designing and building apps that enable users to store payment methods, loyalty cards, and other financial data digitally. These apps streamline the payment process, allowing consumers to pay for products and services directly from their smartphones. For businesses, this means offering a seamless, user-friendly payment option that encourages higher customer satisfaction and engagement.

Fact: Growth of Mobile Wallets

According to Statista, the global transaction value of mobile wallets is expected to reach $14 trillion by 2027, highlighting the shift towards digital payments. This surge shows how crucial mobile wallet app development has become for businesses aiming to tap into the growing base of digital-savvy consumers.

1. Simplified Payment Experience

One of the primary ways mobile wallet app development serves customer engagement is through a simplified payment experience. By allowing customers to make transactions with just a tap on their phone, businesses can reduce friction at checkout. This leads to faster transaction times and a more satisfying experience, making it easier for customers to complete purchases.

Retailers and service providers that adopt mobile wallet solutions can increase the likelihood of repeat business. A fast and hassle-free payment process makes customers more likely to return, boosting both sales and customer retention.

2. Enhanced Security

Security is a top priority for customers when it comes to financial transactions. Mobile wallet app development emphasizes security features such as encryption, two-factor authentication, and biometric verification, which give consumers peace of mind.

For businesses, offering mobile wallets ensures that customers feel safe using their apps for payments. This builds trust and fosters long-term engagement, as customers are more likely to interact with a brand they believe protects their data.

3. Loyalty Programs and Rewards Integration

Mobile wallets are a great tool for integrating loyalty programs and rewards into retail apps. With mobile wallet app development, businesses can easily incorporate loyalty points, special offers, and personalized discounts directly into the wallet app.

This not only makes it convenient for customers to track their rewards but also motivates them to engage more with the app. For instance, a customer might be more likely to shop at a particular store if they can effortlessly redeem loyalty points via the mobile wallet.

4. Push Notifications for Personalized Offers

Mobile wallet app development enables businesses to send push notifications that offer personalized promotions or discounts. These real-time updates are an effective way to keep customers engaged with the brand. Notifications can inform users of sales, remind them to use their rewards, or prompt them to complete a purchase they abandoned.

By delivering timely and relevant offers through a mobile wallet, businesses can maintain consistent engagement, encouraging users to revisit the app and make additional purchases.

5. Improved Customer Insights

Mobile wallet app development allows businesses to gain valuable insights into customer behavior. The data collected from these apps, such as purchase history, preferred payment methods, and shopping habits, can be analyzed to create targeted marketing strategies.

With this information, businesses can better understand their customers’ needs and preferences, resulting in more personalized and engaging interactions. By leveraging this data, companies can improve customer satisfaction and loyalty.

6. Contactless Payments Amid Health Concerns

The COVID-19 pandemic has accelerated the need for contactless payments, and mobile wallet app development has emerged as an essential solution. Customers prefer contactless payments due to their safety and convenience, and businesses that offer mobile wallet options are seen as more responsive to health concerns.

This shift not only improves the user experience but also builds trust between the business and its customers. The adoption of contactless payments is likely to continue growing, making mobile wallets a vital component of customer engagement strategies.

7. Streamlined In-App Purchases

For businesses offering products or services within an app, mobile wallet app development simplifies in-app purchases. Instead of redirecting customers to external payment gateways or requiring them to enter credit card details manually, mobile wallets allow users to make purchases with a few taps.

This streamlined process reduces the risk of cart abandonment and enhances customer satisfaction. When purchases are made easier, customers are more likely to complete their transactions and return for future purchases.

Conclusion

Incorporating mobile wallet app development into retail and service apps has proven to be a powerful way to engage customers. By offering simplified payment experiences, enhanced security, loyalty integration, and personalized offers, mobile wallets provide a seamless and user-friendly platform for businesses to interact with their audience.

The future of mobile wallet app development is bright, as the demand for digital payments continues to grow. Businesses that invest in this technology today will likely see long-term benefits in terms of customer engagement, loyalty, and revenue.

Mobile wallets have transformed the way businesses and customers interact, and the trend shows no signs of slowing down. Companies that embrace this technology will not only enhance their customer experience but also position themselves for success in the rapidly evolving digital marketplace.