Bitcoin has emerged as one of the most influential digital currencies, fundamentally altering the financial landscape by introducing a decentralized form of payment. With the rising adoption of Bitcoin, the demand for automated systems to facilitate smooth, fast, and secure transactions has also increased. This has led to the development of Bitcoin automatic payment systems, which allow users to automate their cryptocurrency payments with ease and efficiency. However, the growing popularity of such platforms raises questions about the security, reliability, and potential risks associated with these systems. In this article, we will explore how secure Bitcoin automatic payment systems like Savastan are and discuss their role in the cryptocurrency ecosystem.

What is Bitcoin Automatic Payment?

Bitcoin automatic payment systems refer to platforms or software that allow users to make recurring or one-time Bitcoin transactions automatically without requiring manual intervention. These systems are primarily designed to simplify cryptocurrency transactions by enabling scheduled payments, such as subscription fees, bills, or other services, without the need for continuous monitoring. They provide convenience for businesses, individuals, and merchants who wish to use Bitcoin for regular payments.

These platforms often support a wide range of features, including multi-currency support, integration with various wallets, and options for both incoming and outgoing transactions. However, despite the advantages, one of the most pressing concerns for users is whether these systems are truly secure.

Security Concerns in Bitcoin Automatic Payment Systems

The security of Bitcoin transactions relies heavily on the cryptographic principles underlying blockchain technology. While Bitcoin itself is considered highly secure, automatic payment systems introduce new variables that users should carefully consider. Let’s dive into some of the primary security concerns associated with these systems.

1. Decentralization vs. Centralization

One of the core tenets of Bitcoin is its decentralization. No single entity controls the Bitcoin network, and transactions are verified by a global network of nodes. However, many Bitcoin automatic payment systems operate through centralized platforms that manage and facilitate the transactions on behalf of users.

When users rely on centralized systems, they must trust the platform to handle their funds securely. This can potentially lead to vulnerabilities, as centralized systems are prime targets for cyberattacks. On the other hand, fully decentralized automatic payment systems may offer a higher level of security, but they often lack the same level of user-friendliness.

2. Hacking and Cybersecurity Threats

Cybersecurity remains a significant concern for any digital payment platform. Bitcoin automatic payment systems are no exception. These platforms may be vulnerable to hacking attempts, which could result in the loss of funds or the compromise of sensitive data.

As the cryptocurrency space continues to evolve, hacking techniques also become more sophisticated. It’s important for users to choose payment systems that offer robust security measures such as multi-factor authentication (MFA), encryption, and cold storage for funds. Regular security audits and updates are also crucial for maintaining the integrity of these systems.

3. Smart Contract Vulnerabilities

Some Bitcoin automatic payment systems use smart contracts to execute transactions automatically. While smart contracts can enhance automation and efficiency, they also come with their own set of risks. A poorly written smart contract could contain bugs or loopholes that can be exploited by attackers.

In the past, there have been high-profile cases of smart contract vulnerabilities leading to significant financial losses in the cryptocurrency space. Therefore, users should look for platforms that have thoroughly tested and audited smart contracts to ensure they are free from vulnerabilities.

Key Features to Look for in a Secure Bitcoin Automatic Payment System

Given the potential security concerns, it’s important to know what features to look for when selecting a Bitcoin automatic payment system. Below are some critical features that can enhance the security and reliability of these platforms.

1. Multi-Signature Wallet Support

Multi-signature wallets require multiple private keys to authorize a transaction, adding an extra layer of security. By requiring multiple signatures for each transaction, the system ensures that a single compromised key won’t result in the loss of funds.

2. Encryption and Secure Data Storage

Encryption is a critical feature for any platform handling sensitive data. Look for systems that offer end-to-end encryption for all communications and transactions. Additionally, secure data storage methods, such as cold storage (offline storage of private keys), are essential to protect against cyberattacks.

3. Regular Security Audits

Reputable Bitcoin automatic payment systems undergo regular security audits by third-party firms to identify potential vulnerabilities and ensure their security protocols are up to date. These audits should be transparent and available for public review to build trust with users.

4. Two-Factor or Multi-Factor Authentication

Two-factor authentication (2FA) or multi-factor authentication (MFA) adds an additional layer of security by requiring users to verify their identity using more than just a password. This can significantly reduce the risk of unauthorized access to user accounts.

5. User Control and Transparency

A reliable Bitcoin automatic payment system should offer users a high level of control and transparency over their funds and transactions. Users should be able to track and monitor all transactions in real-time and receive notifications for any activity.

The Role of Bitcoin Automatic Payment Systems Like Savastan in the Cryptocurrency Ecosystem

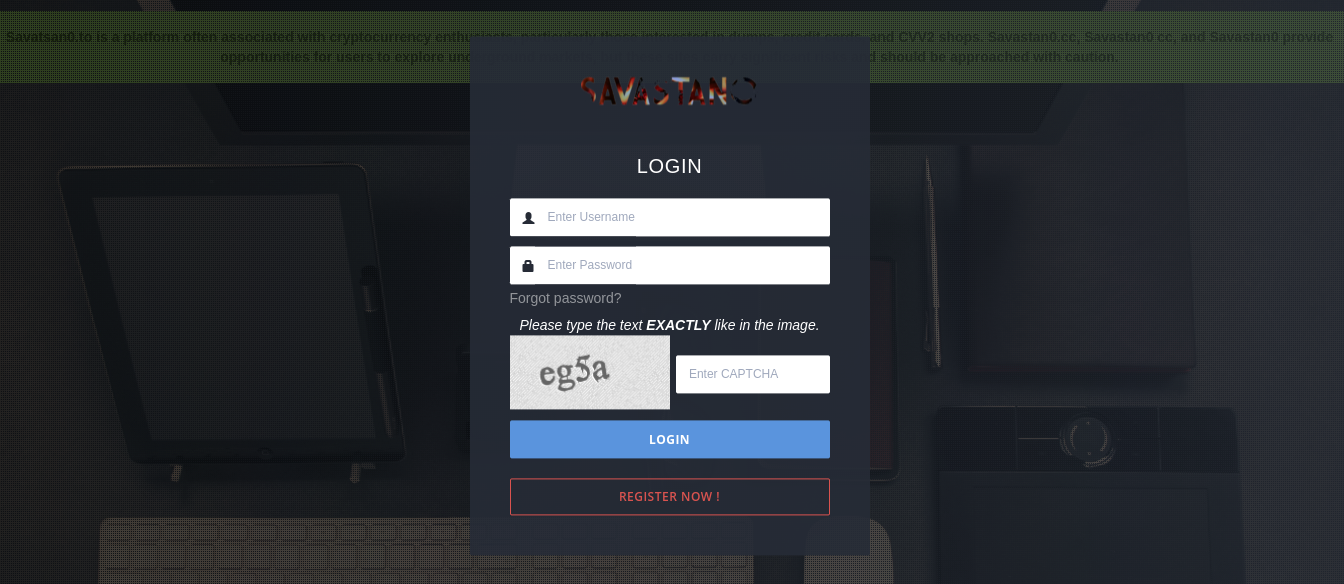

Bitcoin automatic payment systems, like Savastan, play an integral role in the broader cryptocurrency ecosystem by making Bitcoin transactions more accessible and convenient for users. Whether for individuals managing recurring payments or businesses accepting Bitcoin as a form of payment, these systems help bridge the gap between traditional financial systems and the decentralized world of cryptocurrency.

By offering automation, they remove the need for constant manual input, allowing users to set up schedules and handle payments seamlessly. This is particularly useful for subscription-based services, where recurring payments are necessary, or for businesses that want to accept Bitcoin without worrying about delays or manual confirmation of each transaction.

Moreover, these systems often support integrations with popular e-commerce platforms, point-of-sale systems, and wallets, making it easier for merchants to adopt Bitcoin as a payment method. They contribute to the growing adoption of Bitcoin by simplifying its use for everyday transactions.

Conclusion: Balancing Convenience and Security

Bitcoin automatic payment systems provide undeniable convenience in managing cryptocurrency transactions, particularly for recurring payments. However, as with any technology involving sensitive financial data, security should always be the top priority.

By understanding the potential risks and ensuring that the platforms you use offer robust security measures—such as encryption, multi-signature support, and regular audits—you can minimize the risks associated with Bitcoin automatic payment systems. Systems like Savastan are essential in driving the adoption of Bitcoin for both individuals and businesses, but users must remain vigilant and prioritize platforms with strong security practices.

As the cryptocurrency space continues to evolve, it’s likely that we’ll see further advancements in both the convenience and security of Bitcoin automatic payment systems, contributing to the continued growth and mainstream acceptance of Bitcoin as a global payment method.