When it comes to financing investment properties, real estate investors have a myriad of options. One of the most popular methods gaining traction in recent years is the Debt Service Coverage Ratio (DSCR) loan. This financing mechanism allows investors to borrow based on the income generated by the property rather than their personal financial history. However, like any financial tool, DSCR loans come with both benefits and drawbacks. In this blog post, we will explore the pros and cons of DSCR loans in detail, helping you determine if this option aligns with your investment goals.

What is a DSCR Loan?

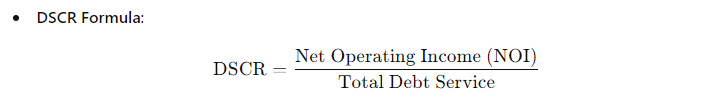

A DSCR loan is designed specifically for real estate investors. The Debt Service Coverage Ratio (DSCR) is a financial metric used by lenders to measure an investment property’s ability to generate enough income to cover its debt obligations. The DSCR is calculated by dividing the property’s net operating income (NOI) by its total debt service.

A ratio above 1 indicates that the property generates sufficient income to cover its debts, making it a lower-risk investment for lenders. For example, a DSCR of 1.25 means the property generates 25% more income than the debt obligations, showcasing a buffer for unforeseen expenses or vacancies.

Pros of DSCR Loans

1. Simplified Approval Process

One of the most attractive features of DSCR loans is their simplified approval process. Traditional loans often require extensive documentation, including proof of personal income, tax returns, and credit reports. In contrast, DSCR loans primarily evaluate the property’s cash flow. This means that even investors with fluctuating personal income or lower credit scores can secure financing if the property’s income is solid.

This streamlined process can save investors valuable time and reduce the stress associated with traditional mortgage applications. For many, it means getting approved for financing much quicker, allowing for timely investment opportunities.

2. No Personal Income Verification

For many real estate investors, particularly those managing multiple properties, the requirement to verify personal income can be burdensome. DSCR loans generally do not require this, focusing instead on the property’s income potential. This aspect is particularly beneficial for investors who have multiple streams of income or those who may be self-employed and find it challenging to provide conventional income verification.

3. Higher Loan Amounts

DSCR loans often allow investors to secure higher loan amounts compared to conventional financing options. Since lenders base their decisions on the property’s cash flow rather than personal income, investors can leverage their rental income to finance larger or more profitable properties. This capability can be especially appealing for those looking to scale their real estate portfolios.

4. Flexible Use of Funds

DSCR loans come with a level of flexibility that can be advantageous for investors. These loans can be used for various purposes, including:

- Purchasing new investment properties

- Refinancing existing loans

- Funding renovations or improvements to increase property value

This versatility allows investors to adapt their financing strategies based on their unique goals and market conditions.

5. Potential for Faster Closings

Since the DSCR focuses primarily on property income and less on the borrower’s personal finances, the closing process can often be quicker. Fewer documents and less scrutiny of personal financial history can result in faster approvals, enabling investors to seize opportunities in competitive markets.

Cons of DSCR Loans

1. Higher Interest Rates

While DSCR loans can be easier to obtain, they often come with higher interest rates compared to conventional loans. Lenders charge more to mitigate the risk associated with these types of loans, which can increase the overall cost of borrowing. Investors should carefully consider how these higher rates will impact their long-term profitability.

2. Property-Specific Risk

One of the significant risks associated with DSCR loans is that they are heavily dependent on the property’s income. If a property’s rental income declines due to factors such as market saturation, economic downturns, or increased vacancy rates, the investor may struggle to meet their debt obligations. This risk is especially relevant in volatile real estate markets where income can fluctuate significantly.

3. Limited Availability

Not all lenders offer DSCR loans, which can limit the options available to investors. This limitation means that investors must conduct thorough research to find lenders who specialize in this type of financing. Additionally, the terms and conditions can vary significantly from lender to lender, making it essential to compare options before proceeding.

4. Potential for Over-Leverage

The nature of DSCR loans can tempt investors into over-leveraging their portfolios. Since the focus is on the property’s income potential, investors might take on more debt than they can comfortably manage. This over-leveraging can lead to financial strain, particularly during economic downturns or periods of high vacancy.

5. Potential for Higher Down Payments

While DSCR loans may not require personal income verification, lenders often require a higher down payment to offset their risk. This requirement can be a barrier for some investors, especially those who are just starting and may not have significant capital available. Understanding the specific down payment requirements is essential before pursuing a DSCR loan.

Key Considerations Before Choosing a DSCR Loan

1. Evaluate Property Cash Flow

Before pursuing a DSCR loan, it’s crucial to thoroughly evaluate the cash flow of the property in question. Ensure that the property’s net operating income comfortably exceeds the debt service obligations to maintain a healthy DSCR. A ratio of 1.25 or higher is generally considered a good target.

2. Understand Market Conditions

Real estate markets can be unpredictable. Understanding current market conditions is vital before investing in a property using a DSCR loan. Conduct thorough research on rental demand, potential growth areas, and economic indicators that may affect property income.

3. Plan for Potential Risks

While DSCR loans can provide valuable financing options, investors must be prepared for potential risks. Have a plan in place to manage fluctuations in income, including setting aside reserves for maintenance, vacancies, or unexpected expenses.

4. Consult with Professionals

Working with real estate professionals, including mortgage brokers, financial advisors, and real estate agents, can provide valuable insights into the best financing options available. These experts can help you navigate the complexities of DSCR loans and ensure that you make informed decisions.

Conclusion

DSCR loans offer real estate investors a unique opportunity to finance properties based on their income potential, rather than personal financial history. With simplified approval processes, no personal income verification, and flexible use of funds, they can be a powerful tool in building a robust real estate portfolio. However, potential borrowers must carefully weigh the pros and cons, considering factors like interest rates, property-specific risks, and market conditions.

By conducting thorough research and consulting with professionals, investors can harness the benefits of DSCR loans while mitigating the associated risks. As with any financial decision, making an informed choice will ultimately lead to more successful and sustainable real estate investments. If you’re considering a DSCR loan, now may be the perfect time to explore your options and take your real estate investment journey to the next level. Happy investing!