Finding affordable health insurance for your family can be stressful, especially when balancing coverage needs and cost. Many families worry about paying for insurance while still getting the health coverage they need. The good news is that it’s possible to secure family coverage that fits your budget without sacrificing quality care.

In this guide, we’ll walk you through the steps to finding affordable health insurance that offers the right coverage options for your family. By understanding what to look for, how to compare plans, and where to find savings, you can ensure your family stays healthy without breaking the bank.

Start by Understanding Your Family’s Health Needs

Before you begin your search for affordable health insurance, take a moment to assess your family’s specific health needs. This will help you understand which plans offer the best value. For example, consider the following:

- Do any family members have chronic health conditions or special medical needs?

- Are you expecting any major medical events in the near future, such as childbirth or surgery?

- How often do you visit doctors or specialists?

Knowing these details helps you identify plans that meet your family’s needs and helps you avoid paying for unnecessary coverage. A clear understanding of your needs can also help you decide between a basic plan and a more comprehensive custom plan.

Explore Your Health Insurance Options

There are several options when it comes to purchasing family coverage. Here are the most common:

1. Employer-Sponsored Health Insurance

If one or both parents have access to health insurance through their job, this could be the most budget-friendly option. Many employers pay a significant portion of the premium, making it an attractive choice for families. However, be sure to review the plan’s coverage options to ensure it meets your family’s needs.

2. Marketplace Plans

The Health Insurance Marketplace allows families to compare various coverage options. You can find plans under the Affordable Care Act (ACA) that provide essential health benefits. Depending on your household income, you might also qualify for subsidies that can lower premiums, making these plans a great choice for families looking for affordable coverage.

3. Medicaid and CHIP

If your family has a lower income, you may qualify for Medicaid or the Children’s Health Insurance Program (CHIP). Both programs offer budget-friendly health coverage, including doctor visits, hospital stays, and vaccinations for children. These government-sponsored programs have different eligibility criteria based on income and state, so be sure to check whether you qualify.

4. Private Health Insurance

If you don’t qualify for Medicaid or need a plan outside of the Marketplace, you can purchase private health insurance directly from insurance providers. While this can be more expensive, there are still affordable plans available, especially if you don’t need extensive coverage.

5. Short-Term Health Insurance

For families who need temporary coverage, short-term health insurance can be a budget-friendly option. These plans are less comprehensive than traditional plans but can help cover basic health needs for a limited time.

Consider Custom Plans to Meet Your Family’s Needs

Some health insurance providers offer custom plans that allow you to adjust the coverage based on your family’s needs. These plans can be more affordable since they let you pay only for the services you will use. For example, if you have young children who only need basic care, you can opt for a plan that covers pediatric services while skipping less essential benefits.

When choosing a custom plan, keep in mind that flexibility can sometimes result in higher out-of-pocket costs. It’s essential to balance the savings from reduced premiums with the potential for higher co-pays or deductibles.

Key Factors to Consider When Choosing a Plan

When searching for affordable health insurance for your family, focus on several key factors that can affect both the cost and the coverage:

1. Premiums and Deductibles

The premium is the amount you pay each month for your insurance. The deductible is how much you must pay out of pocket before the insurance company starts covering your medical expenses. While it’s tempting to choose the plan with the lowest premiums, it’s essential to consider the deductible as well. Lower premiums often come with higher deductibles, meaning you could end up paying more when you need care.

2. Out-of-Pocket Costs

In addition to premiums and deductibles, consider co-pays, coinsurance, and the out-of-pocket maximum. These costs can vary significantly from one plan to another. Be sure to estimate how much you would pay for doctor visits, prescriptions, and hospital stays.

3. Coverage Limits

Some plans have limits on how much they will pay for certain services. Make sure to read the fine print to understand what’s covered and what isn’t. A plan with limited coverage might seem affordable but could leave you paying for essential services out-of-pocket.

4. Provider Networks

Check the list of doctors and hospitals included in the plan’s network. If your family’s primary care doctor or specialists are out-of-network, you may face higher costs. Always ensure that the plan offers access to the healthcare providers your family uses.

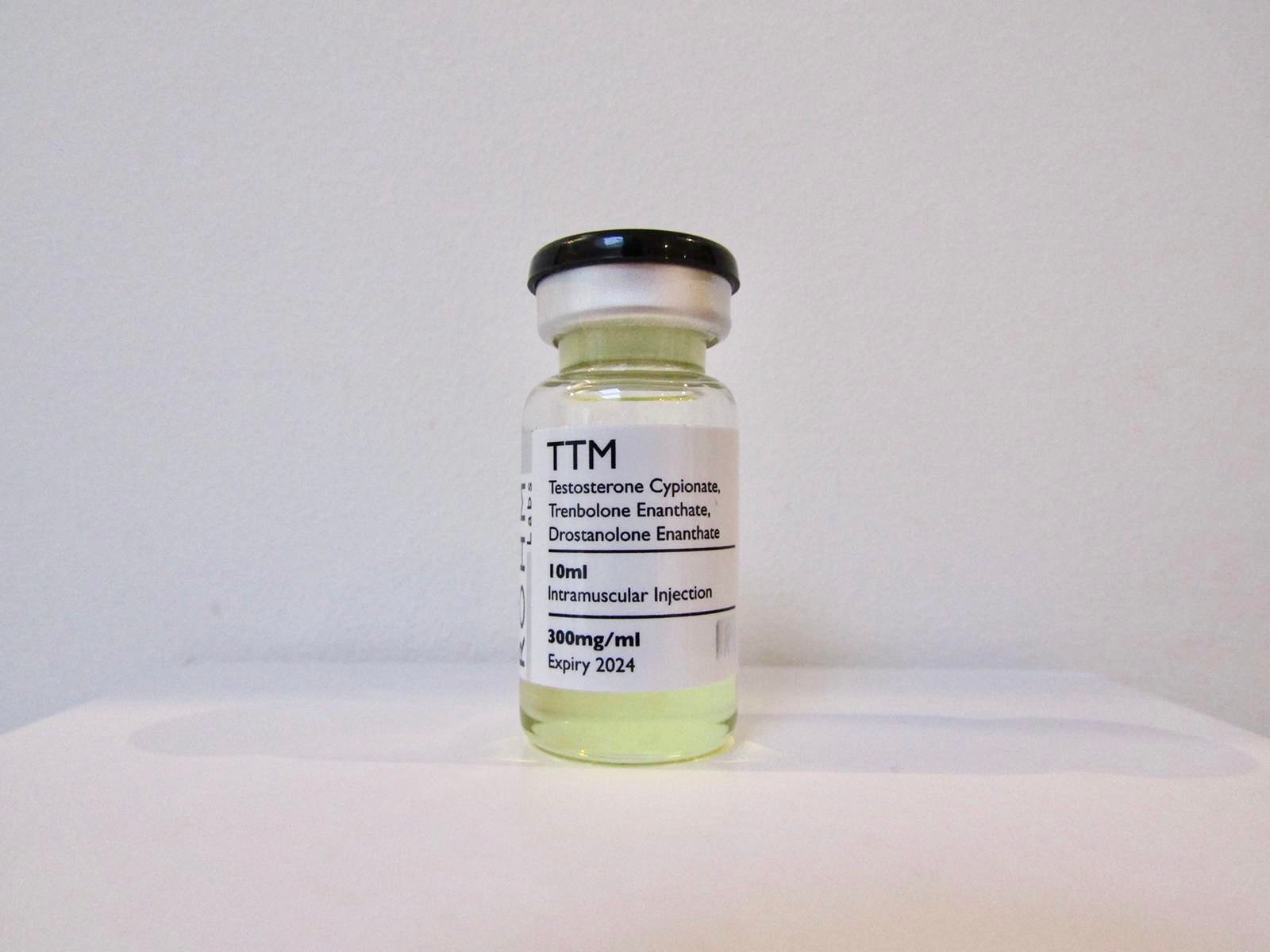

5. Prescription Drug Coverage

Prescription drug costs can add up quickly, especially if anyone in your family requires ongoing medication. Some plans have better prescription drug coverage than others, so compare the formulary (list of covered drugs) and the cost of medications under different plans.

Look for Subsidies or Discounts

If you qualify for subsidies, they can significantly reduce the cost of your premiums. Under the ACA, families with a household income between 100% and 400% of the federal poverty level may qualify for financial assistance. In addition to subsidies, many insurers offer discounts for paying premiums annually rather than monthly, or for enrolling in wellness programs.

How to Keep Your Family’s Health Insurance Affordable

Once you’ve found an affordable health insurance plan that offers comprehensive coverage, here are a few ways to help you keep costs down over time:

- Use Preventive Care: Many insurance plans cover preventive care at no extra cost. Regular check-ups, vaccinations, and screenings can catch health issues early and help avoid expensive treatments later on.

- Explore Health Savings Accounts (HSAs): If you’re enrolled in a high-deductible plan, an HSA allows you to save money tax-free for medical expenses. This can help you pay for care without taking a financial hit.

- Consider Telemedicine: Many insurance plans offer telemedicine services, which allow you to consult with doctors remotely. This is often a more affordable option than in-person visits for minor health concerns.

- Shop Around Annually: Health insurance plans change every year, and you might find better coverage or lower premiums during open enrollment periods. Always shop around to make sure you’re getting the best deal.

Conclusion

Finding affordable health insurance for your family doesn’t have to be a stressful or overwhelming process. By understanding your family’s health needs, exploring different coverage options, and considering custom plans, you can find a solution that fits both your budget and your family’s health requirements. While it’s important to save on premiums, remember that adequate coverage is essential for protecting your family’s well-being.

At The Benefits Boss, we’re here to help you find the best budget-friendly health insurance plans without compromising on coverage. Let us guide you through the process and ensure that you and your family get the care you need at an affordable price.

Related Post: 10 Smart Tricks To Find The Best Health Insurance Policy