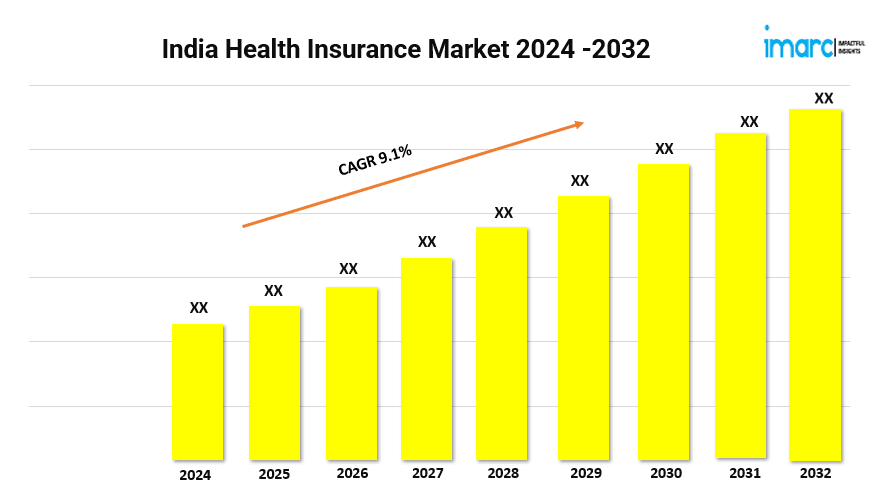

India Health Insurance Market Overview

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 9.1% (2024-2032)

With increasing healthcare costs and a growing middle class, the demand for health insurance in India is surging. According to IMARC Group, The India health insurance market size reached US$ 132.9 Billion in 2023. Looking forward, the market to reach US$ 291.0 Billion by 2032, exhibiting a growth rate (CAGR) of 9.1% during 2024-2032.

Grab a sample PDF of this report: https://www.imarcgroup.com/india-health-insurance-market/requestsample

India Health Insurance Industry Trends and Drivers:

The India health insurance market is expanding rapidly, owing to several key factors. Primarily, the desire for comprehensive coverage is being driven by individuals and their households because of rising healthcare expenses and growing awareness of the policy’s significance. Furthermore, the expanding middle-class population and the increasing prevalence of lifestyle-related illnesses, like diabetes, hypertension, and heart ailments, are contributing to higher insurance adoption rates. In line with these factors, several initiatives of government bodies, like the Ayushman Bharat scheme, which aims to provide affordable healthcare to millions, have also fueled the expansion of the India health insurance market. Additionally, with the impact of the COVID-19 pandemic, more people are recognizing the value of health insurance for financial protection against unforeseen medical expenses.

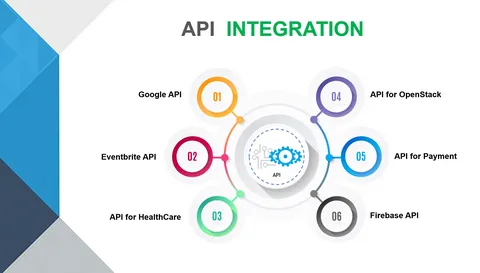

Several trends, including technological advancement and development in the sector, are shaping the India health insurance market. The digitalization of healthcare services, such as online policy purchases and telemedicine, has made health insurance highly accessible and efficient. Insurers are introducing customized and flexible policies to cater to the diverse needs of consumers, including family plans, critical illness coverage, and top-up options. Moreover, the integration of technology, such as AI-driven claims processing and health apps that monitor wellness, is improving the customer experience and encouraging preventative healthcare. Apart from this, the market is also seeing increased collaboration between insurance companies as well as healthcare providers to offer cashless treatment options, further boosting the appeal of health insurance in India. Consequently, the convergence of these factors is anticipated to propel the expansion of the India health insurance market in the coming years.

Our comprehensive India health insurance market outlook reflects both short-term tactical and long-term strategic planning. This analysis is essential for stakeholders aiming to navigate the complexities of the market and capitalize on emerging opportunities.

India Health Insurance Industry Segmentation:

The report has segmented the market into the following categories:

Provider Insights:

- Private Providers

- Public Providers

Type Insights:

- Life-Time Coverage

- Term Insurance

Plan Type Insights:

- Medical Insurance

- Critical Illness Insurance

- Family Floater Health Insurance

- Others

Demographics Insights:

- Minor

- Adults

- Senior Citizen

Provider Type Insights:

- Preferred Provider Organizations (PPOs)

- Point of Service (POS)

- Health Maintenance Organizations (HMOs)

- Exclusive Provider Organizations (EPOs)

Regional Insights:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145